Main Content

UW Tacoma Grad, Author and Finance Expert Dan Wickens responds to your Money Matters questions

I am looking to purchase a vehicle. There's an alternative method to finance through a savings-secured loan (Pledge Loan) through Navy Federal. Can you explain the pros/cons of this option and if its worth considering given the high auto interest rates.

_______________________________________________________

Thanks Kelsy! This is an excellent question.

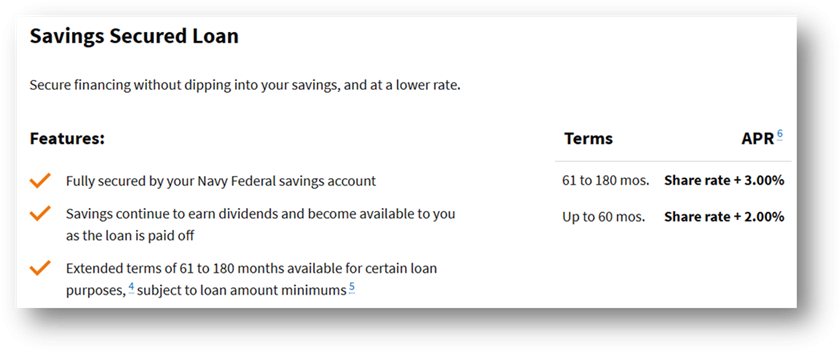

I looked up the savings-secured loan through Navy Federal, and if I found the right product, I can see why you’re intrigued (link and snip below to confirm). I haven't previously done much research on this specific type of product, so it was fun to learn and think it through.

Quick disclaimer: my reply does not represent professional financial advice, and we are not engaged in a service agreement of any kind. Simply put, I’m here as a friend 😊

Savings-secured loan vs. traditional auto loan

Without more specific details of the product, based on Navy Federal's site I generally expect the pledge loan would be both cheaper and more flexible for you compared to a traditional auto loan. Some folks even use pledge loans as a preferred credit building tool. For example, I read about people taking a pledge loan, immediately paying most of it back, and adjusting their installment payment amount to pay tiny amounts for the rest of the term. While any loan will likely decrease credit scores initially (the inquiry and the increase in total debt amount are both negatives) the users mitigated this by paying back most of the debt immediately and then expanded their positive credit history by paying their installment loan timely. That may not be an option with all products, but sharing in case it's helpful to consider.

I think the risks are likely similar between savings-secured and a traditional auto loan, since both are collateralized (pledge loan secured by your cash, auto loan secured by your car). As a conceptual note, I think the reason they can offer a lower rate for a pledge loan is because the cash collateral is better compared to a vehicle, which depreciates with time and usage. However, it would be good to make sure you understand what would happen in the event of missed payment or default, and if there are any penalties for early repayment if you decide to do so. Then you can compare that to what you know about traditional auto loans.

As long as there's nothing too sinister in the savings-secured loan fine print, it seems like a valid alternative to a traditional auto loan and may be cheaper and/or more flexible.

Savings-secured loan vs. cash

It sounds like you already have cash that you'd be using to secure/collateralize the loan, so that leads to the question – why not just use the cash for your purchase? Why pay interest if you don’t have to? Really, that comes down to personal preference and opportunity costs. Full transparency - I've never used a pledge loan, so I don't want to assume I know every nuance, but I think I understand it enough to form a general opinion.

For any given person, I suspect the material opportunity costs of using your existing cash to pay for the vehicle up front instead of using it to secure a loan are:

1. Lost flexibility. You'd save on the interest costs of the loan, but your cash would be gone-gone. However, make sure you understand when/how your cash would become available to you again as the pledge loan is repaid. Some folks may decide that the cost of the interest is worth the flexibility, compared to the finality of sending all the cash out the door at once. This comes down to personal preference, as well as reasonably projecting other life/cash needs over the term of the loan. Again though - most important is to understand when/how cash becomes available under the savings-secured loan, so that you can reasonably compare your liquidity.

2. Lost credit-building opportunity. Using a loan of some kind provides credit-building if needed/desired; however, depending on severity of the need or desire to build installment credit, this may not be worthwhile.

Hope that helps, and thanks again!

P.S. this is the product I found and was reviewing.

Thanks!

- Crowdfunding

- Person to person loan (i.e. borrow from an individual)

- Bringing in a partner who can finance

Defense first

First, make sure you have no credit card debt or other high interest debt. If you currently carry high interest debt, the best thing for your financial position is likely to put the funds toward paying those down. If high interest debt isn’t a concern, the next step is to check your emergency savings – do you have a minimum of 1 month of living expenses saved, or more preferably, at least 3 months worth? The reason this is also a priority prior to investing is because if disaster strikes – car trouble, medical bills, income loss – having the emergency savings serves as defense against toxic credit card debt, which often charges 24% or more in interest. Don’t count on any investment performing better than that consistently. And, even if invested funds are in a highly accessible account, you risk having to withdraw them in a market downturn. If you decide to save some or all of your bonus in an emergency savings, it would look pretty in a high yield money market account, earning decent interest without compromising access to funds.

Ok, now that I’ve nagged about proven defensive strategies, let’s look at the fun stuff.

Now build your lead!

You’ve made some money, you’ve set up your defense against disaster, and now you’re ready to go build on what you’ve started. Assuming you’re hoping to invest for long-term purposes (i.e. retirement) my preference is to use a tax-advantaged account and index funds. If you are eligible (and most people are), putting your money in a Roth IRA could be a great choice. I personally prefer this over a brokerage, since it will grow tax free forever while remaining reasonably accessible. If you stuck your bonus into a Roth IRA and earned 8% for 40 years, it would grow tax-free to over 24x its original value. If it earned 10% for the same period, it would be worth nearly 54x. Woohoo!

With long-term investing in a Roth IRA, I prefer to focus on proven equity index funds rather than trying to hit it big with more speculative investing. If you invest early and often enough, you don’t need to hit the jackpot. A lot of folks like choosing a combination of large cap, mid cap, small cap, and international index funds. Or, some just go with large cap, such as a fund built to track the S&P 500.

Here are some links to a reputable site that describes more about index funds and Roth IRAs.

https://www.investopedia.com/terms/i/indexfund.asp

https://www.investopedia.com/roth-ira-4771236

Wrapping up

I’m happy to hear you’re getting a bonus! Well-earned I’m sure. I hope that whatever you decide to do, it feels like a win. And if you carve out some of your funds to treat yourself to something fun, I think that’s great too. Thanks again for the question, and good luck!